With a $300 travel credit (versus the Mastercard Black’s $200 airline credit), stronger point earning rates and points that can be redeemed for travel through Chase’s portal at 1.5 cents per point or transferred to one of Chase’s airline or hotel partners. With a $550 annual fee and a $75 authorized user fee, the Chase Sapphire Reserve® offers the sort of card the Mastercard Black wants to be. Spend that with the Citi Double Cash and earn $660-more than enough to pay for the best perks offered by the Mastercard Black and then some. To earn back the cost of its annual fee, the Mastercard Black requires $33,000 in spending. The Double Cash may not have the travel benefits of the Mastercard Black, but even without the $0 annual fee, it bests the potential rewards earned. After that, the fee will be 5% of each transfer (minimum $5). An intro balance transfer fee of either $5 or 3%, whichever is greater, applies to transfers completed within the first 4 months of account opening. After that, the standard variable APR will be 19.24% - 29.24%, based on creditworthiness. It also offers a 0% intro APR on balance transfers for 18 months. The Citi® Double Cash Card offers 2% cash back on all purchases-1% when purchases are made and another 1% when they’re paid off. That would be enough points for $641.44 in airline tickets or $481.08 in cash back. A typical user would earn 32,072 points in a given year. Since the Mastercard Black Card doesn’t offer category bonuses, we can make the simple calculation. Assuming 50% of such expenses are charged to this card, total annual card spending would be $32,072. The 70th percentile of wage-earning households brings in $107,908 annually and has $64,144 in standard expenses. To determine potential rewards earnings, Forbes Advisor uses data from various government agencies in order to determine both baseline income and spending averages across various categories.

Points earned with the Mastercard Black can be redeemed as a statement credit or deposit at a rate of 2% value for airfare redemptions and 1.5% value for cash back redemptions. Points may be forfeited for a list of fine print reasons, most of which involve fraudulent activity but some of which are as vague as, “your history of Account usage.” Redeeming Rewards Points don’t expire as long as the account remains open and in good standing and, “as long as the program continues.” Points cannot be redeemed when an account is past due. The Mastercard Black earns 1 point per dollar spent on all purchases with no cap.

#Black card american express requirements full

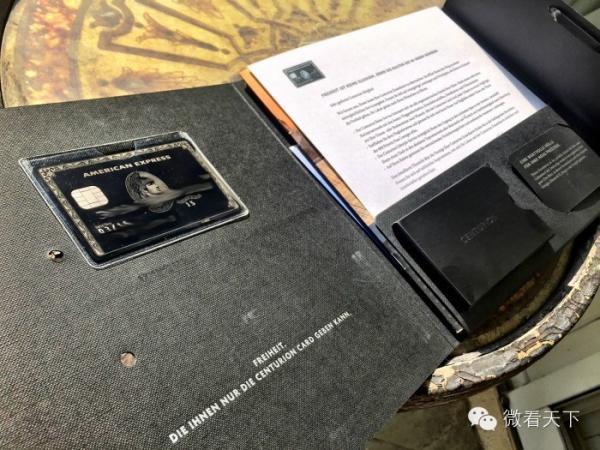

The Mastercard Black offers a stainless steel and carbon card that weighs a full 22 grams-that’s one full gram more than a human soul. It’s difficult to stomach an entire paragraph about how this credit card is actually made of metal and has 70 patents worldwide, but it is 2023 and stranger things are happening. With “VIP Travel” perks including Priority Pass lounge access, a 24/7 travel concierge available via mobile app, up to a $100 TSA PreCheck or Global Entry credit and $100 in airline incidental credits for baggage and other similar expenses, the Mastercard Black seems to be trying to make the card live up to the hefty annual fee, but doesn’t do it as well as other cards. The Mastercard Black focuses plentiful advertising on travel perks.

The card offers a 0% intro APR on balance transfers for 15 months, but with a balance transfer fee of either $5 or 3% of the amount of each transfer, whichever is greater and high annual fee, there are better balance transfer options available. These earnings fall short compared to other premium cards with high annual fees.

For spending $50,000 a cardholder earns 50,000 points redeemable for $750 cash back or $1,000 in airline tickets. The $495 ($195 for each Authorized User added to the account) annual fee awards cardholders an unlimited 1 point per dollar spent, redeemable at a rate of 2% value for airfare redemptions and 1.5% value for cash back redemptions.

The card promises luxury while screaming “brussels sprout in a Ferrero Rocher wrapper” in the way an immaculately dressed hotel guest screams at the staff about how much money they’re worth. More words on the homepage of the Mastercard Black credit card are devoted to description of the physical card and its patented design than to anything else.

0 kommentar(er)

0 kommentar(er)